How to Build a Recession-Proof Portfolio: 5 Strategies Financial Advisors Won't Tell You

In today's unpredictable economic climate, the idea of a recession looms large in the minds of investors. With the recent market fluctuations and economic instability, many are searching for ways to protect their investments against potential downturns. The fear of losing hard-earned money during a recession is a real concern, and building a recession-proof portfolio has become a priority for savvy investors. In this article, we'll explore five strategies that can help you safeguard your investments during turbulent times—techniques that financial advisors might not always disclose. By incorporating these strategies into your financial plan, you'll be better equipped to weather any economic storm and emerge with your portfolio intact.

Diversification: The Bedrock of Stability

Diversification is a fundamental principle of investing, yet its importance cannot be overstated, especially during a recession. By spreading your investments across various asset classes, you reduce the risk of significant losses. A well-diversified portfolio typically includes stocks, bonds, real estate, and commodities, among others.

“Diversification is the only free lunch in investing.” — Harry Markowitz, Nobel Laureate in Economic Sciences

Consider including international investments to further diversify your portfolio. Economies do not always move in tandem, so foreign stocks and bonds can offer a buffer against domestic downturns. The key is to balance your portfolio in such a way that it can withstand shocks from any single sector or geographical area.

Focus on Defensive Stocks

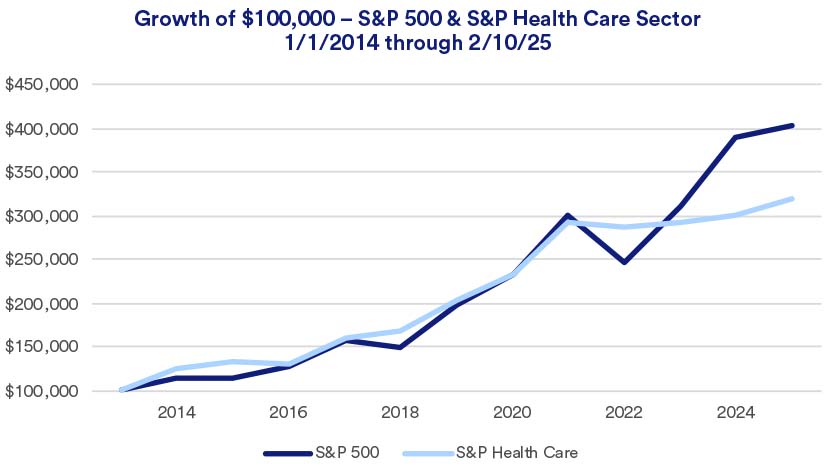

Defensive stocks are those that tend to remain stable or even appreciate during economic downturns. These typically include companies in essential sectors such as utilities, healthcare, and consumer staples. During a recession, consumers still need electricity, healthcare, and basic household goods, making these stocks less volatile compared to others.

When selecting defensive stocks, look for companies with strong balance sheets, consistent dividend payouts, and a history of weathering economic downturns. These characteristics often indicate resilience and can provide a steady income stream even when the market is down.

Bond Investments: A Safe Haven

Bonds are traditionally viewed as a safer investment compared to stocks, and they can be an essential component of a recession-proof portfolio. Government bonds, in particular, are considered low-risk and can provide a reliable income stream during uncertain times.

“Bonds are a better investment than stocks when the economy is slowing down.” — Warren Buffett, CEO of Berkshire Hathaway

Consider diversifying within the bond market itself by including a mix of short-term and long-term bonds, as well as corporate bonds with strong credit ratings. This approach can help mitigate risk and offer higher yields than government bonds alone.

Alternative Investments: Thinking Outside the Box

Alternative investments, such as real estate, precious metals, and private equity, can offer unique opportunities for growth and protection during a recession. Real estate, for example, often appreciates over time and can provide rental income even during economic downturns.

Precious metals like gold and silver tend to retain their value and can act as a hedge against inflation. Private equity, though riskier, can offer significant returns if chosen wisely. These investments require careful consideration and often a longer time horizon, but they can be valuable additions to a recession-proof portfolio.

Maintain Liquidity and Flexibility

In times of economic uncertainty, maintaining liquidity is crucial. Having cash or cash-equivalents on hand allows you to take advantage of market opportunities and make timely adjustments to your portfolio. A liquid portfolio gives you the flexibility to pivot quickly in response to market changes. This might mean selling underperforming assets or buying undervalued ones. The key is to maintain a balance between long-term investments and accessible funds to capitalize on market shifts.

Conclusion

Building a recession-proof portfolio requires a strategic approach and a willingness to think beyond conventional wisdom. By diversifying your investments, focusing on defensive stocks, incorporating bonds, exploring alternative investments, and maintaining liquidity, you can create a resilient financial plan that stands strong against economic downturns. Now is the time to evaluate your current portfolio and make the necessary adjustments to protect your financial future. Remember, the goal is not just to survive a recession but to thrive in its aftermath. Equip yourself with these strategies, and you'll be well-prepared for whatever economic challenges lie ahead.