How Apple's $500 Billion Move Can Grow Your Investment Portfolio

Introduction In an era where economic dynamics rapidly evolve, significant corporate financial movements often signal broader market shifts. Apple Inc., a bellwether in technological innovation and market influence, has recently announced a staggering $500 billion investment in artificial intelligence and augmented reality technologies. This strategic allocation not only underscores Apple's commitment to pioneering new technologies but also presents a unique opportunity for investors to recalibrate their portfolios. This analysis will explore how Apple's massive investment could serve as a catalyst for growth in personal investment portfolios, focusing on diversification strategies, the ripple effect on related sectors, and long-term growth potential.

The Impact of Apple's Investment on Tech Sector Dynamics

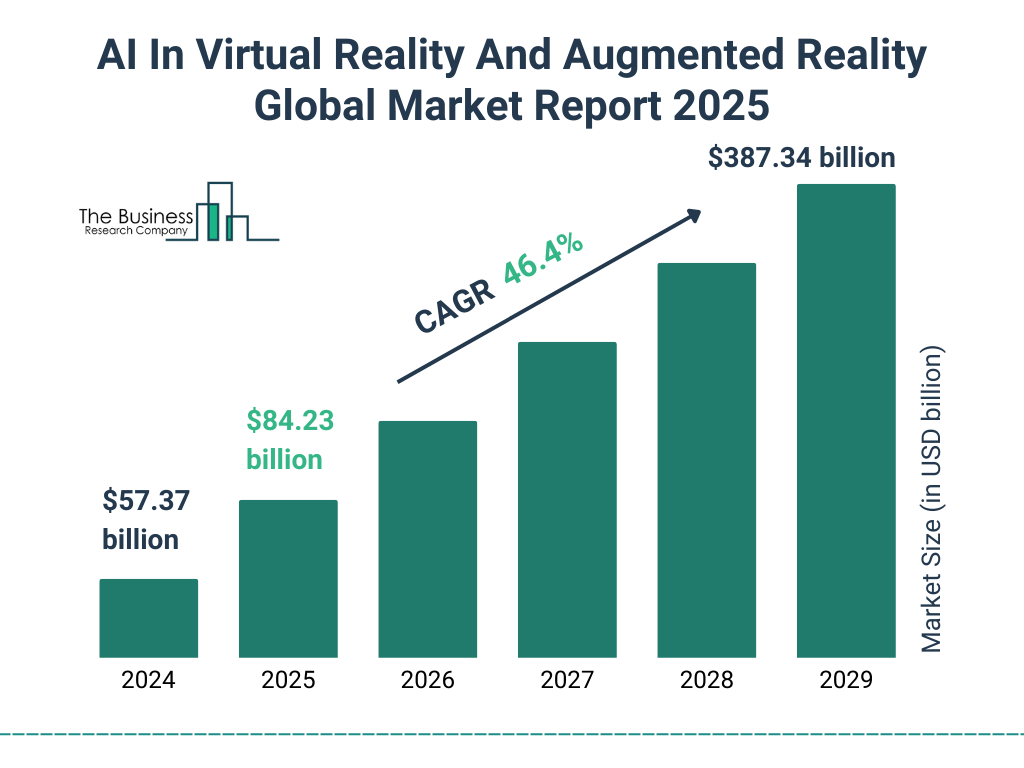

Apple's recent financial move is set to redefine competition and innovation within the tech sector. By funneling $500 billion into AI and AR, Apple is not just enhancing its product offerings but is also setting a new standard for technological integration.

For investors, this creates a fertile ground for growth in several ways: - Direct investment in Apple's stock could yield significant returns as the company harnesses new technologies to boost its market dominance. - Substantial investments in AI and AR will likely drive up stock values for companies within Apple’s supply chain or those involved in similar technologies. - Broader sector growth can benefit even smaller tech firms that adopt or enhance these technologies, offering a wider field of investment opportunities.

Strategic Diversification Through Related Industries

Investing in technology alone, especially a giant like Apple, might not suit all risk profiles. However, Apple’s strategic move can indirectly benefit a range of associated sectors and industries, offering diversified investment opportunities:

- Consumer Electronics: Companies that produce components for Apple products could see an uptick in demand.

- Software Development: Firms specializing in AI and AR applications may experience growth due to increased demand for advanced software solutions.

- Entertainment and Media: Enhanced AR capabilities could revolutionize how content is created and consumed, benefiting companies in this sector.

Investors should consider these sectors for diversification, balancing their portfolios across various industries to mitigate risks associated with the volatility of the tech sector.

Long-Term Growth Potential and Market Leadership

Apple’s investment is not just a boon for short-term traders but also for long-term investors. The integration of AI and AR into consumer products is expected to set a new trend, potentially making Apple a frontrunner in another wave of tech innovation. This positions Apple as a compelling option for those looking to invest in a company with both a strong current standing and promising future prospects. Additionally, Apple's market leadership and robust financial health provide a safety net for investors. The company's history of successful market disruptions suggests that its $500 billion move could lead to substantial economic shifts, benefiting patient investors who focus on long-term capital growth.

Conclusion

Apple's monumental $500 billion investment in AI and AR technologies is poised to reshape not only its future but also the landscape of global technology and investment. By understanding the implications of this move and considering strategic diversification, investors can enhance their portfolios, tapping into both direct and indirect growth opportunities. As the tech giant paves the way, staying informed and agile will be key to leveraging these developments for portfolio enhancement. This article is for informational purposes only and does not constitute financial advice.