7 Breakthrough Tools to Maximize Your Wealth in 2025

As the winds of economic change swirl around global markets, many investors and savers find themselves navigating a landscape that is simultaneously ripe with opportunity and fraught with uncertainty. The primary challenge for many is maximizing the efficiency and growth of their financial resources in an era defined by rapid technological advancement and shifting economic conditions. This post outlines groundbreaking financial tools and strategies poised to redefine wealth management in 2023. You will discover everything from innovative investment platforms to smart budgeting applications designed to optimize your financial health and assist you in achieving your monetary goals.

Robotic Process Automation in Finance

The adoption of Robotic Process Automation (RPA) is transforming how we manage finances by automating mundane tasks and enabling more strategic investment decisions. RPA can help individuals save time and reduce errors in managing their portfolios by automatically executing trades, rebalancing, and monitoring investments according to predefined rules. This ensures that your investment strategy remains robust no matter how turbulent the markets. For instance, J.P. Morgan recently integrated RPA to reduce transaction processing times by as much as 75%. This significant enhancement in operational efficiency underscores the potential benefits for individual investors seeking to streamline their finance management processes.

AI-Driven Financial Advisory Services

The surge in artificial intelligence technology has birthed advanced AI financial advisors, providing personalized investment advice with unprecedented accuracy. These tools analyze vast amounts of data to offer tailored recommendations based on your unique financial goals, risk tolerance, and time horizon.

A recent report by Gartner predicted that by 2025, AI financial advisory services will be used by over 60% of high net worth individuals worldwide.

Platforms like Betterment and Wealthfront use AI to automate portfolio management, thereby enabling both seasoned and novice investors to reap the benefits of a sophisticated investment strategy without the necessity of constant monitoring. Suggested tools include robo-advisors, predictive analytics for market trends, and custom alerts related to your investments.

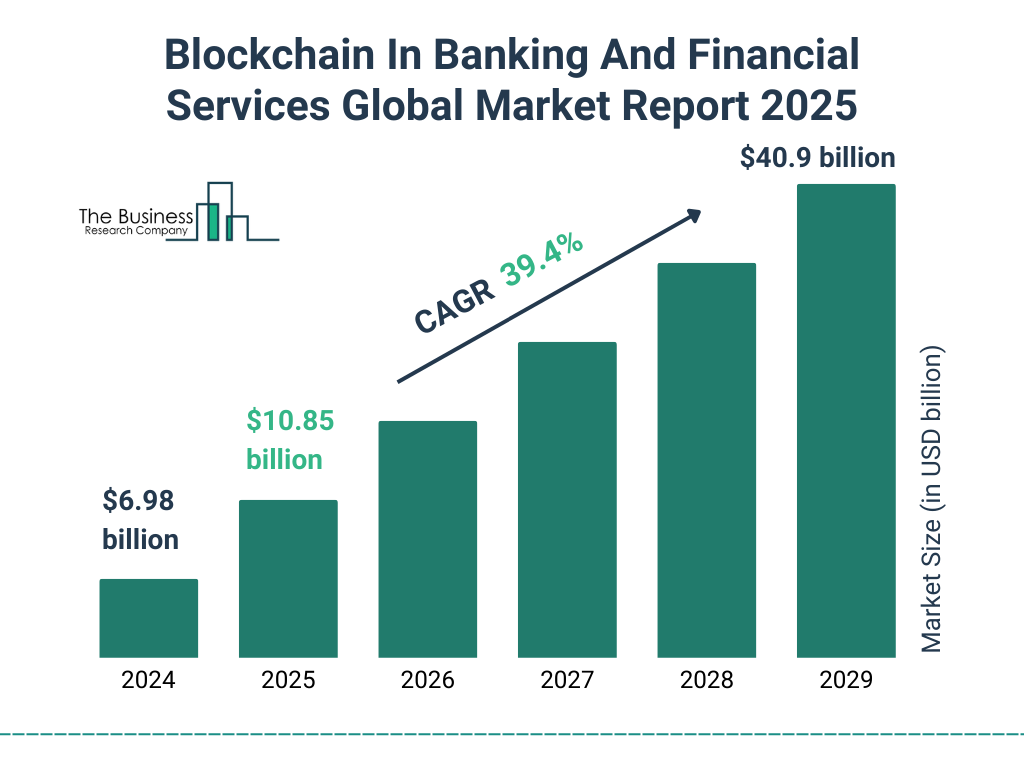

Blockchain-Based Solutions

Blockchain technology offers a high level of security and transparency and is making significant inroads into the financial industry, particularly in wealth and asset management. Blockchain can revolutionize the way we own and trade assets, from real estate to intellectual property, through tokenization, which makes fractional ownership possible across a much wider array of assets.

- Blockchain-enhanced tools allow quicker verifications and safer transactions, reducing the risk of fraud.

- Smart contracts automatically execute agreements based on triggers, ensuring all parties meet their obligations.

Companies like Tokeny and Harbor are at the forefront, providing platforms that enable the tokenization of assets, thereby democratizing access to investment opportunities previously limited to wealthy individuals or institutional investors.

Self-Learning Budgeting Applications

Harnessing the power of machine learning, new-age budgeting applications are not just tracking expenditures but also predicting future spending habits and recommending ways to save money. Apps like Mint and YNAB (You Need A Budget) analyze monthly expenses and provide insights on where one could cut down expenditures or increase savings. They take data-driven personal finance management to another level by not just monitoring but actively suggesting improvements to financial habits.

Conclusion

To harness the potential of the financial tools highlighted, it is imperative for individual investors to stay informed about the latest technological advancements and be open to adapting their financial strategies accordingly. Start by identifying which tools align best with your financial goals, whether it be through sophisticated AI-driven advisories for investment management or robust blockchain solutions for secure transactions. Embrace these innovations to navigate the complex landscapes of modern finance, and optimize your wealth effectively. With the tools described, proactive wealth management in 2023 can be not only more efficient but also more exciting. This article is for informational purposes only and does not constitute financial advice.